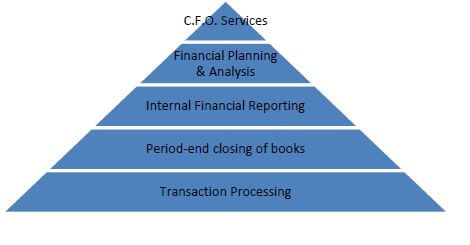

March 27, 2018 – A strong system of accounting and financial management is vital to the success of every business. A business’s strength in this…read more

Congress Puts Your Golf Game in the Bunker: The new rules for Meals and Entertainment under the TCJA

March 14, 2018 – Business deals have been created and closed during an 18-hole round of golf, drinks, and dinner. Inviting a client out to…read more

March 8, 2018 – “30% of Adjusted Taxable Income” – That is the new, very important, limitation that Congress has placed on the deductibility of…read more

On February 9, 2018 as part of the continuing resolution to fund the government through March 23rd, Congress extended some tax deductions and credits through…read more

With the passing of the Tax Cuts and Jobs Act on December 22, 2017, many changes took place from the tax law we knew so…read more

February 20, 2018 – One important step to both reducing taxes and saving for retirement is to contribute to a tax-advantaged retirement plan. If your…read more

February 15, 2018 – On December 20, Congress completed passage of the largest federal tax reform law in more than 30 years. Commonly called the…read more

February 14, 2018 – In 2015 Congress decided to “repeal and replace” the old tax audit regime for entities that file Form 1065 Partnership returns. And…read more

February 12, 2018 – As part of tax reform several changes impacting tax depreciation took effect on September 27, 2017. However, these changes are not…read more

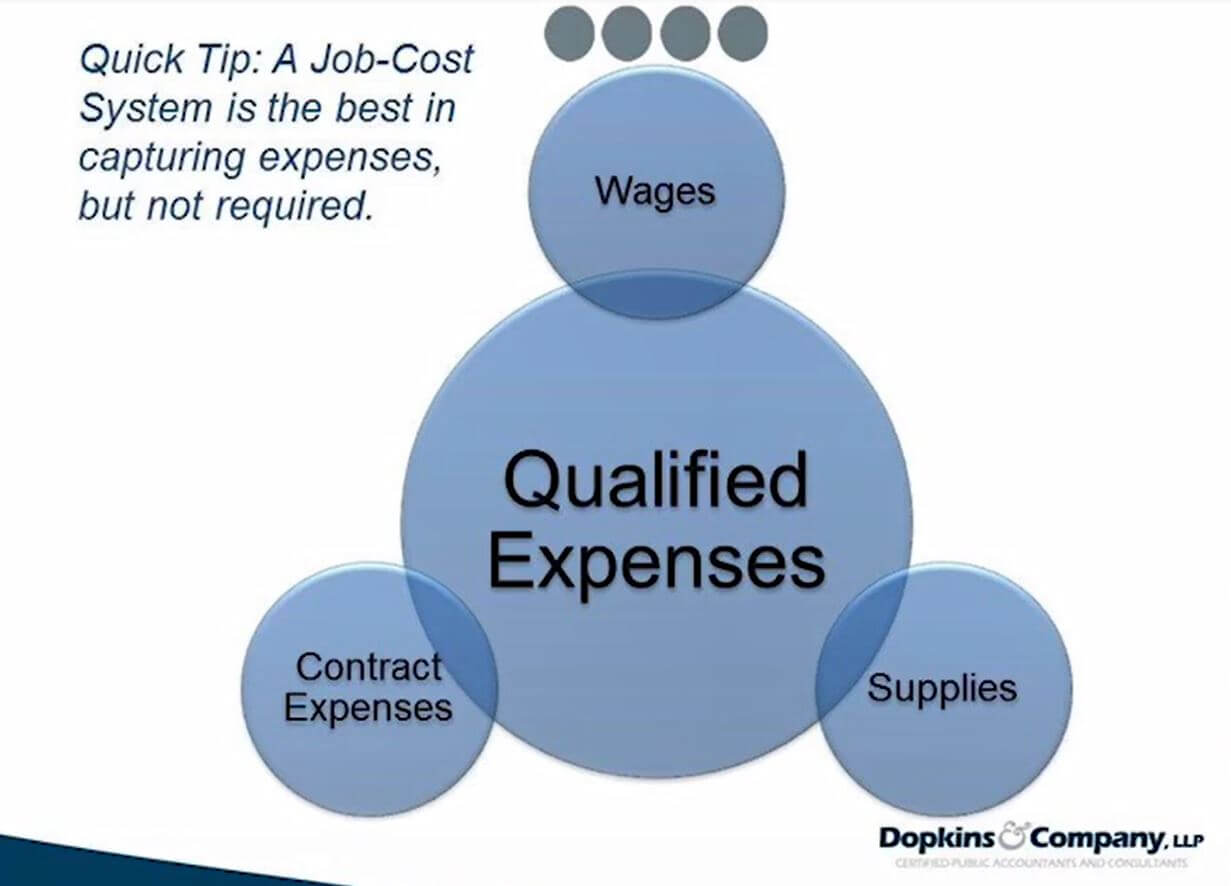

In our 4th Research & Development video installment, we discuss Qualified Research Expenses (QREs), which are defined as the expenses a taxpayer is allowed to…read more