Increase Profitability through a Co-Sourcing Strategy

January 12, 2021 | Authored by Dopkins Client Accounting & Advisory Solution (CAAS) Team

A Case Study illustrating the high cost when departmental staff regularly performs the work of another department

Topic in this Issue: the Right People

Published January 2021 – One of the challenges faced by many organizations today is ensuring company resources, i.e. time and dollars, are utilized in the most productive, unwasteful way. Unfortunately, the reality is most organizations on average incur about 15% waste defined as non-value add activity performed by people and machines. Although historically associated primarily with the manufacturing floor in terms of visible “scrap” material, waste is unfortunately also very prevalent in many service industries today as well as the administrative departments of traditional manufacturers.

The resulting process waste, to which this type of inefficiency is often referred, typically manifests itself in several ways. A few of the more costly of these waste areas are:

- Defects – services that do not conform to customer expectations

- Waiting – periods of inactivity caused when an “upstream” department does not deliver on time.

- Motion – Unnecessary movements by people

- Extra-processing – More work or higher quality than is required by the customer

- Non-Utilized Talent – Underutilizing people’s talents skills and knowledge

Of the waste areas mentioned above, non-utilized talent is perhaps worthy of further discussion as it is a special challenge to manage because the cost is not always easily assessed.

Non-utilized talent generally occurs when people are asked to perform activity outside of their “swim-lane.” Examples include payroll processing staff assigned to receivable collections, accountants formatting and word processing their own financial reports, the H/R manager performing IT help desk duty, nursing staff looking for misplaced medical charts, just to name a few. At first glance, one might mistakenly assume that this is suggesting certain jobs of one are somehow “beneath” that of another. That is not the case! Rather, what it does illustrate is that people, regardless of their position within the company, have specific skills, talents and knowledge that need to be utilized at their fullest potential to be most productive for the organization. For example, accountants may be skilled in number crunching but not so much at word processing which should best be performed by administrative staff who possess the necessary expertise.

One reason this particular waste area is often hard to understand and mitigate is that quantifying the waste is not easily calculated through the traditional accounting system which typically tracks costs by department.

CASE STUDY:

Illustrating the high cost when departmental staff regularly performs the work of another department.

Recently our firm was engaged to assess the accounting function of a small manufacturer. The accounting department consisted of a Controller and two staff accountants. Other than during the fourth quarter where transactions typically tripled during that time, this small team was capable of handling departmental workflow. Management decided that available staff from the administrative support department could provide seasonality assistance when needed during the fourth quarter and reasoned that this would save the company unnecessary personnel expenses. Bill paying, payables, and other related duties were therefore all performed with some help from available administrative staff. For the most part, these duties were performed adequately and on time. Management, although aware this might not have been an optimal solution, was pleased that the accounting function was “covered.” But when the true cost of delivering the accounting activity was finally determined, the nature of the underutilization waste became apparent.

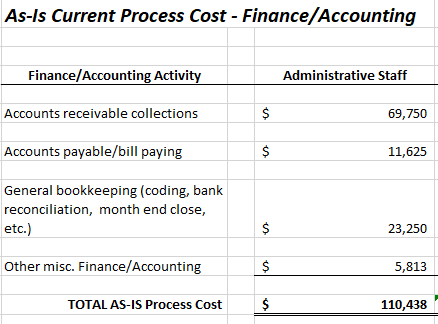

Activity-based management was employed to determine the cost of delivering the accounting function. The administrative staff members were asked to complete an activity survey allocating their time to their primary job activity and to the accounting function. Once allocated, their respective “people cost” (salary and benefits) could be assigned to the appropriate activity and quantified. The amount of costs assigned to the accounting function resulted in the following:

The assessment results were staggering. The amount of administrative support department staff resources being consumed by accounting activity was over $110,000. Factoring in the work was performed by non-accountants, the efficiency of the work performed was called into question. In other words, an accountant likely could have completed the tasks in much less time with much less cost. Perhaps more importantly, it became apparent that this underutilization waste also represented a huge opportunity cost in terms of administrative support activity, which was deemed to be less than adequate by company senior management who were the primary “consumers” of the administrative support staff services.

To remedy the situation, management decided to co-source the accounting function. Full-time accounting clerical assistants were still deemed not necessary due to the seasonality of the need. However, engaging a firm to collaboratively manage the accounting assistance proved to be a cost-beneficial alternative. The external firm provided a team of professionals that took over the bill paying and related activity requiring only a few hours per month to manage. This allowed the administrative support team to remain in their “swim-lanes” and maximize the value they were hired to provide to the organization while the accounting function was performed at less than half the current underutilized activity cost.

Aligning company resources for the maximum benefit to the organization is not easy. Many organizations attempt to compensate by requiring their team to perform activity outside their respective swim-lanes often resulting in underutilization waste. By understanding the true cost of this type of waste, organizations can often achieve their objectives by engaging a co-sourcing solution. Most notably, the example above when applied to larger organizations can yield even more significant savings.

Aligning company resources for the maximum benefit to the organization is not easy. Many organizations attempt to compensate by requiring their team to perform activity outside their respective swim-lanes often resulting in underutilization waste. By understanding the true cost of this type of waste, organizations can often achieve their objectives by engaging a co-sourcing solution. Most notably, the example above when applied to larger organizations can yield even more significant savings.

Putting it all Together

Our Client Accounting and Advisory Solution (CAAS) team provides a great co-sourcing strategy. Consider eliminating the cost of underutilization waste with a TEAM of professionals who are experts at their craft, engage standard processes to leverage efficiency and timely deliverables, and can be engaged for blended rates that are more typical of a full time hire with much less experience and qualifications.

About the Author

Dopkins Client Accounting & Advisory Solution (CAAS) Team

Dopkins Client Accounting & Advisory Solution (CAAS) is centered on helping our clients transform the accounting and finance function of their businesses to more effectively confront challenges and seize opportunities in four critical areas: Talent, Resources, Risk and Counsel. For more information, contact Albert A. Nigro, CPA, CVA at anigro@dopkins.com.