The Election and the Markets

August 21, 2024 | Authored by Ryan C. Smith CFP®

For more information, contact Ryan Smith at rsmith@dopkins.com.

The 2024 election season is in full swing with Biden stepping down recently, making the election set up for a Trump vs. Harris ticket. This all is making the U.S. public concerned with the possible affects from either outcome. No matter the outcome, political tensions will likely remain heightened throughout the next president’s term, adding to the everchanging global political climate. Many investors are uneasy with how the financial market may be impacted by the results. This article from Jared Kizer at Buckingham Strategic Partners helps investors understand what to keep in mind.

1. Geopolitical risks are already priced into markets.

For as long as markets have existed, they have continuously priced in geopolitical risks. Stock prices have endured world wars, regional conflicts, revolutions, and countless other geopolitical events. Investors can use this historical record to understand the risk that exists in most stock and bond allocations. It is of our opinion, a good starting point when investors begin to worry is for them to ask themselves this question: “Setting aside the upcoming election, am I comfortable with the historical risks and returns that my allocation has experienced?” If you’re unsure about your answer, you should talk to your financial advisor as they can help you understand your portfolio’s historical risk profile. This helps you determine if you are taking on more risk than you are comfortable with.

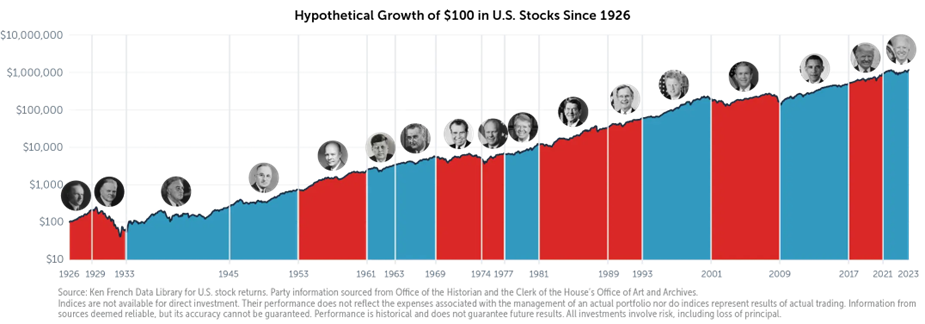

2. Election outcomes have little impact on stock markets, and the U.S. economy is better poised to withstand a global slowdown compared to other economies.

There is ample evidence showing that the outcome of a presidential election has not impacted the stock market in one direction or the other. The federal policies enacted in the next president’s term matter more to the stock market than who is in office. That said, the markets constantly price in how such policies could play a role in the economic growth, inflation, and other indicators of the markets.

3. Investors benefit from favorable stock market pricing conditions.

While the markets are pricing in the latest geopolitical news, investors should also consider how a company’s stock price compares to the dollars they earn. Recently, the news is positive across most asset classes. For the U.S. stock market smaller and more value-leaning companies are being valued at levels closer to their historical averages, even though the large-cap stocks are trending above their historical valuation levels. This segues into our last point on the importance of diversifying and resisting the impulse to chase investments with the highest returns.

4. Diversification is your friend – especially during uncertain times.

It is difficult to determine which sectors or industries could benefit as a result of the elections potentially reshaping policies and legislation. Broad diversification is the most effective way to manage risk, geopolitical or otherwise. The election outcome will not influence the current trends for the stock market and no one can successfully predict what stocks will outperform over the next year. This is why investors should consider maintaining their allocations across global stock markets and to high-quality bonds.

If the 2024 election is concerning you with how your portfolio could be impacted, contact your financial advisor to discuss your risk profile and making sure you are well diversified. Taking a break from the election coverage doesn’t hurt as well.

* Dopkins Wealth Management, LLC is a registered investment advisor owned by the partners of Dopkins & Company, LLP.

Source: Ken French Data Library for U.S. stock returns. Party information sourced from Office of the Historian and the Clerk of the House’s Office of Art and Archives.

https://www.buckinghamstrategicwealth.com/resources/investing/protecting-your-portfolio-in-a-presidential-election-year

About the Author

Ryan C. Smith CFP®

Ryan provides financial solutions to individuals, trusts and businesses. His services include guidance to clients regarding financial planning, investments and portfolio analysis.