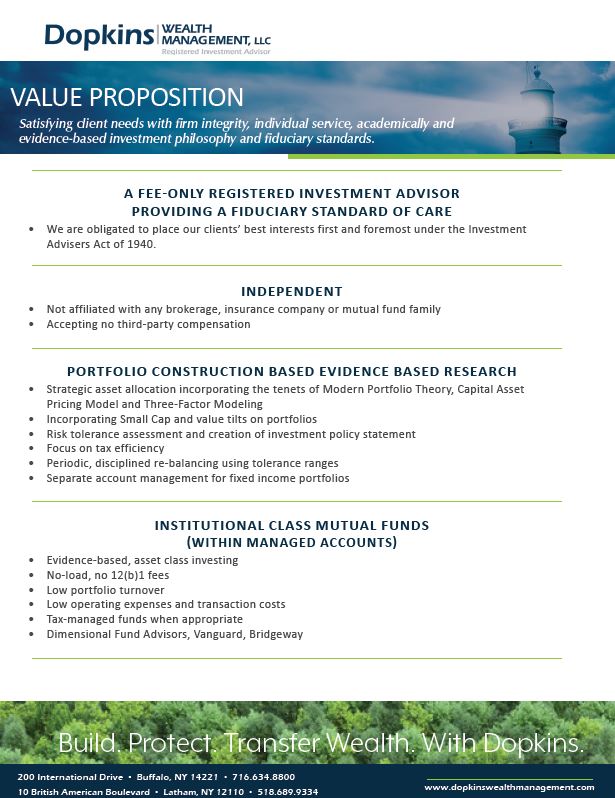

Our Value Proposition

Satisfying client needs with firm integrity, individual service, academically and evidence-based investment philosophy and fiduciary standards.

A Fee-Only Registered Investment Advisor Providing a Fiduciary Standard of Care

We are obligated to place our clients’ best interests first and foremost under the Investment Advisers Act of 1940.

Independent

- Not affiliated with any brokerage, insurance company or mutual fund family

- Accepting no third-party compensation

Portfolio Construction Based Evidence Based Research

- Strategic asset allocation incorporating the tenets of Modern Portfolio Theory, Capital Asset

- Pricing Model and Three-Factor Modeling

- Incorporating Small Cap and value tilts on portfolios

- Risk tolerance assessment and creation of investment policy statement

- Focus on tax efficiency

- Periodic, disciplined re-balancing using tolerance ranges

- Separate account management for fixed income portfolios

Institutional Class Mutual Funds (Within Managed Accounts)

- Evidence-based, asset class investing

- No-load, no 12(b)1 fees

- Low portfolio turnover

- Low operating expenses and transaction costs

- Tax-managed funds when appropriate

- Dimensional Fund Advisors, Vanguard, Bridgeway

Client Planning Services

INVESTMENT PLANNING

Portfolio Construction

- Current portfolio analysis

- Assessing the ability, willingness and need to take risk

- Determining appropriate asset location: Taxable vs. Tax-deferred

- Bond portfolio management services

Portfolio Management

- Rebalancing

- Tax Management

- Performance Tracking

PLANNING FOR LARGE CAPITAL COMMITMENTS

Education Planning

- Selecting appropriate funding vehicles

- Payment strategies: transfer of assets, financing

- Determining appropriate asset allocation

Retirement Planning

- Selecting appropriate funding vehicles

- Retirement analysis using Monte Carlo simulation

- Employee benefit decisions: maximizing employer-sponsored plans

Major Purchases

- Funding and finance decisions

RISK MANAGEMENT:

LIFE, DISABILITY, LONG-TERM CARE AND PROPERTY & CASUALTY INSURANCES

- Needs Assessment

- Review of existing coverage

ESTATE PLANNING, WEALTH TRANSFER & WEALTH PROTECTION

- Determining the Appropriate Strategy and Vehicles

- Charitable Gift Planning

COMPLIMENTARY PORTFOLIO REVIEW

* Dopkins Wealth Management, LLC is a registered investment advisor owned by the partners of Dopkins & Company, LLP.